The Zig Zag Oscillator study is a modified version of the the native Sierra Chart Zig Zag study, as described at the following link – Zig Zag.

The calculation methods are identical and many of the options are also mirrored between the studies. Unlike the native study, this study is specifically for displaying the Zig Zag Oscilllator, the distance, in points, from the current close to the prior swing point.

Note:

- It is recommended to use ‘Intraday Data Storage Time Unit‘ setting ‘1 Tick’

Inputs

Use Reference Study for Zig Zag (In:11)

When enabled, the study settings relating to zig zag calculation are copied from the main zig zag study (if present). This allows easier synchronization of settings between zig zag type studies.

Reference Zig Zag Study (In:12)

Defines the reference zig zag study with which to link the input settings.

Note: The Zig Zag study drives the settings on the linked studies, not the other way around, therefore when ‘Use Reference Study for Zig Zag’ is enabled, inputs 3 to 13 will always reflect the equivalent inputs on the zig zag study.

Input Data – High (In:1)

Defines the data array to use for High values in the zig zag calculation, for details see – Input Data for High.

Input Data – Low (In:2)

Defines the data array to use for Low values in the zig zag calculation, for details see – Input Data for Low.

Calculation Mode (In:3)

Defines which calculation method is used for the zig zag, for details see – Calculation Mode.

Mode 1 – Reversal % (In:4)

The minimum percentage price change that must occur to begin a new zig zag line when using calculation mode 1.

- Min: 0

- Max: 100

Mode 2/3 – Reversal Amount Mode (In:5)

Determines how the reversal amount for modes 2 and 3 is specified.

- Price

Uses the ‘Price’ input, i.e. the actual price change value. - Ticks

Uses the ‘Ticks’ input, i.e. the price change measured in ticks.

Price (In:6)

Defines the minimum change in price that must occur to begin a new zig zag line when using calculation modes 2 and 3.

- Min: 0

- Max: 3.4028 x 10^38 (max value for single precision floating point variable)

Ticks (In:7)

Defines the minimum price change in ticks that must occur to begin a new zig zag line when using calculation modes 2 and 3.

- Min: 0

- Max: 1000000

Mode 2 – Bars Required (In:8)

Defines the number of price bars required to begin a new zig zag line when using calculation mode 2, see the following link for more details – Calculation Mode 2.

Reset Zig Zag Oscillator (In:9)

- No

The zig zag calculation is never reset. - Trading Day

The zig zag calculation is reset at the beginning of each trading day, as defined by the chart session times. - Session

The zig zag calculation is reset at the beginning of each trading session, as defined by the chart session times.

Calculate on Bar Close (In:10)

When enabled the zig zag calculation is only updated on the close of the chart bar.

This is useful to avoid a new zig zag line beginning when reversal conditions are only present temporariliy intra-bar, but not at the close of the chart bar.

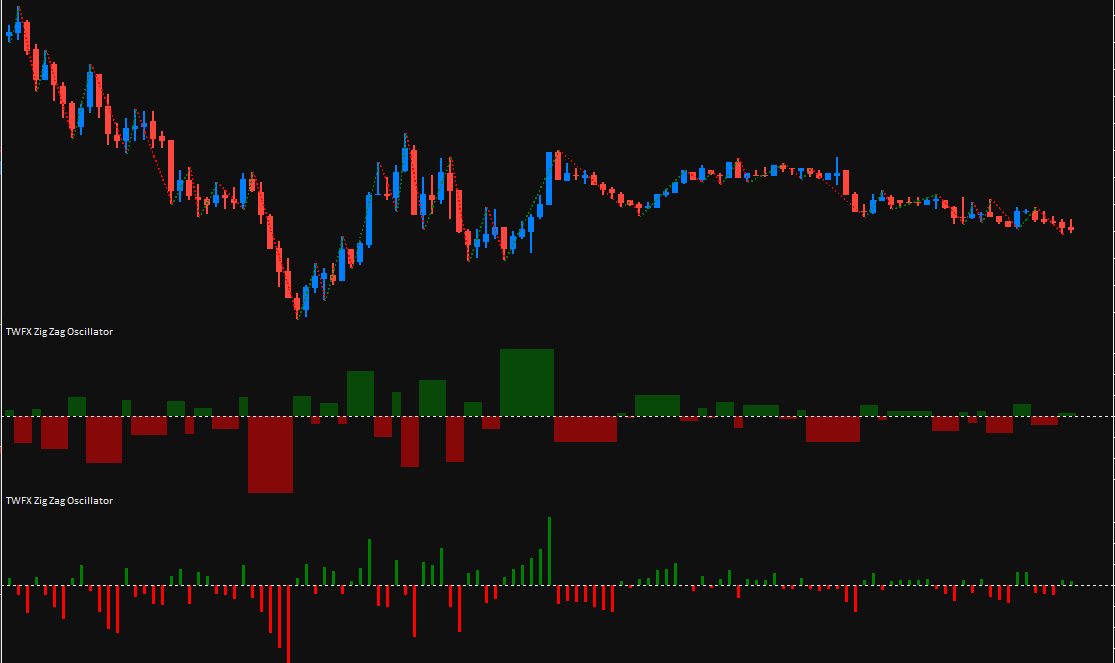

Display Mode (In:13)

Defines how the zig zag oscillator should be displayed on the chart.

- Histogram

Each chart bar displays the distance, in points, between the current bar close and the previosu swing point. - Box

Each chart bar is updated to always display the distance, in points, between the most recent bar close and the prior swing point.

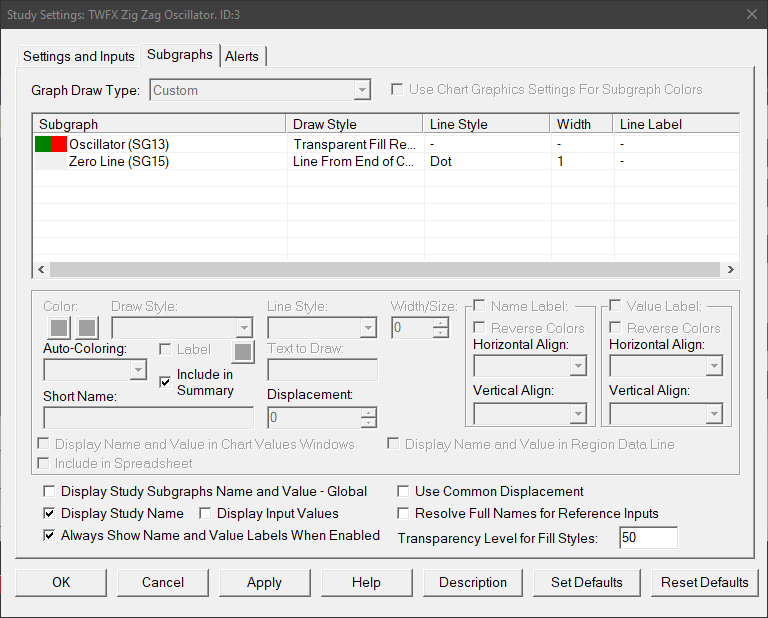

Subgraphs

Oscillator (SG13)

Default: Transparent Fill Rectangle to Zero

Displays the distance, in points, between the bar close and the prior swing point.

Primary color is used for positive values, secondary color for negative values.

Zero Line (SG15)

Default: Line from End of Chart Left to Right

Displays line at zero.